Original Xirui Tech Planet

Tech planet (wechat id: tech 618)

Wen | Xi Rui

Cover Source | Picture Worm Creativity

"I said in August this year that the 17-year-old good product is facing the most difficult challenge since its establishment. At the moment, this challenge is still intensifying. "

At the end of November this year, Yang Yinfen, the newly appointed chairman and general manager of Liangpin Store, bluntly stated the difficulties encountered by the company in an open letter.

Once the "first share of high-end snacks" was no longer covered up, and even decided to "self-degrade".

The first thing Yang Yinfen did when he took office was to reduce the average price of 300 products of Liangpin Store by 22%, with the highest drop of 45%, involving nuts, preserved meat and other categories. The stores with trial operation told Tech Planet that the price reduction measures have achieved initial results, which will bring more passengers and even new customers to the stores without reducing the unit price of customers.

Behind the price reduction of good shops, the impact pressure brought by snack discount stores is inseparable. This new species that has sprung up suddenly has landed in nearly 10,000 stores this year.

The year-on-year decline in revenue and the rapid expansion of snack discount stores are telling good shops that they are getting farther and farther away from the real consumer demand.

The largest price reduction of "the first share of high-end snacks" in 17 years

In Huang Xinyi’s memory, Liangpin Store is the first snack collection store in their county, which is located at the crossroads in the center of the county. All snacks can be bought at random, which became a trend at that time. "Since I had a good shop, my mother didn’t take me to the supermarket to buy snacks every New Year," Huang Xinyi recalled.

But this "family tradition" has changed since last year. After snack discount stores have blossomed everywhere in the county, good shops are no longer the place to buy snacks in Huang Xinyi. "With the same budget, snack shops can buy two bags, but good shops can only buy one bag," Huang Xinyi told Tech Planet.

Expensive, become the most obvious label of good shop now. Yang Yinfen, chairman and general manager of Liangpin Store, confronted this problem in an internal open letter. "The reality that consumers think we are expensive also shows that the price of our products must be more close to the people."

The biggest price reduction measure in 17 years is to face the problem directly. This is Yang Yinfen’s first business-side measure after taking office. The average price reduction of 300 products is 22%, with the highest drop of 45%.

A month ago, good shops have implemented price reduction measures in Shanghai, Hangzhou and other places. Tech Planet found in a good shop in Shanghai that the price-cut goods will be presented in the form of membership price, and the original price will be specially marked on the label.

It is estimated that nearly 40% of the goods in the store have been reduced in price, and the reduced-price goods are concentrated in nuts, preserved fruits, meat and some bread cakes.

The manager of the good shop told Tech Planet that every winter, nuts and meat are the best sellers, and then the Spring Festival is superimposed. Nuts are the focus of new year’s goods. "Nuts are very dry, and no one will eat them in summer."

Macadamia nuts, pecans, almonds, pine nuts, pistachios, cashews, etc. are all important in the price reduction of good shops. Obviously, good shops hope to reappear in consumers’ living rooms during the Spring Festival.

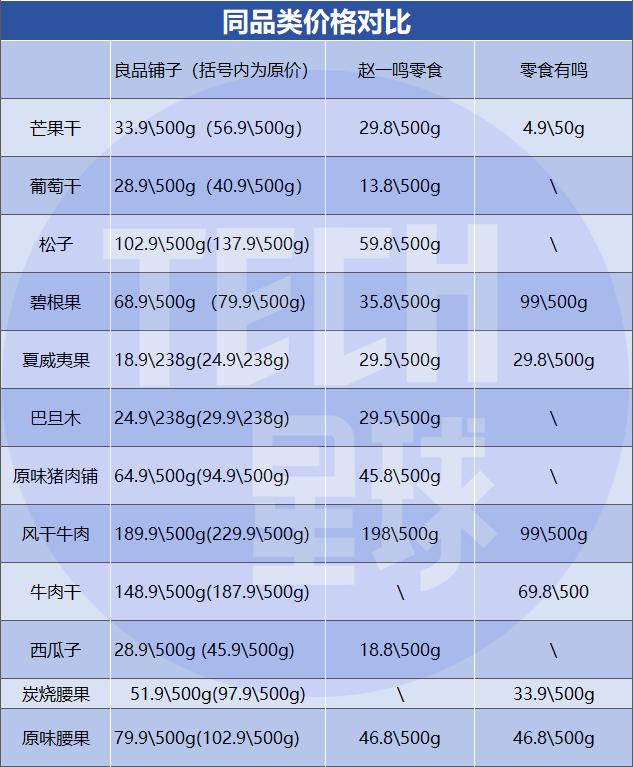

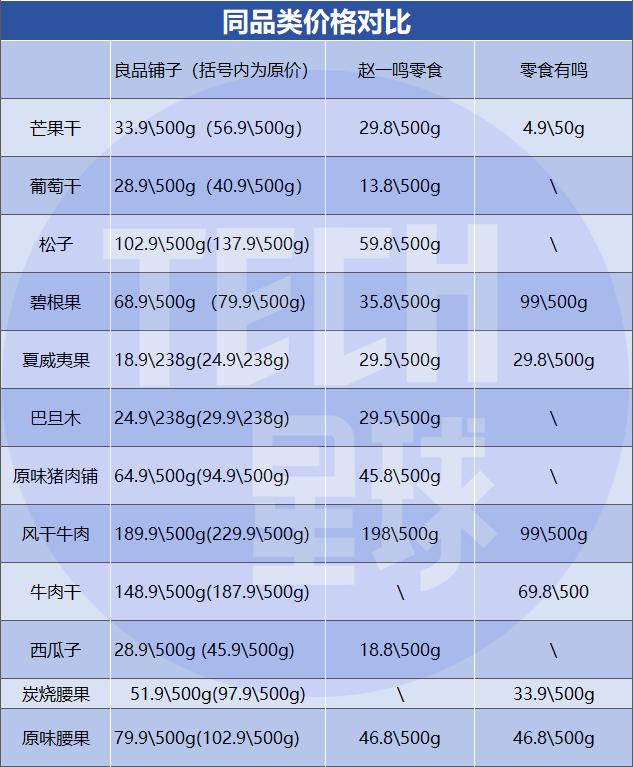

However, compared with snack discount stores such as Zhao Yiming and Snacks Youming, in the dimension of price, the good shops after price reduction still have no advantage. Tech Planet compares the prices of some goods in the same category and finds that the prices of preserved fruits and meat in good shops can reach the same level, but there is still a certain price difference in nut categories.

Legend: Price comparison of brands in the same category.

However, no one will refuse the promotion. Whether in Shanghai or Hangzhou, people have returned to the stores of good shops for the sake of price reduction. "There are still quite a lot of people who come to buy membership-priced goods every day," Zhang Ji, a clerk at a good shop in Hangzhou, told Tech Planet. Moreover, to her surprise, this price cut did not bring about a decline in the unit price of customers.

According to the data of Narrow-door Dining Eye, the customer unit price of good shops is 55.83 yuan, while snacks are busy at 38.79 yuan, and Zhao Yiming is in 37 yuan.

"As long as customers who come to the store can’t just buy goods at reduced prices, they will buy some other goods," Zhang Ji told Tech Planet. "We will also recommend best-selling snacks to customers."

"Price-cutting goods are actually a drainage function to attract customers to the store," the clerk of the good shop told Tech Planet. This is the most desirable result for good shops.

When high-end snacks are only "expensive"

"The store’s business is not bad," Zhang Ji told Tech Planet. "It’s basically flat every month." But she is one of the lucky few.

The revenue of good shops has declined year-on-year for five consecutive quarters. In the third quarter of this year, good shops sold 2.013 billion yuan, down 4.53% compared with the same period last year. As of September this year, in nine months, good shops sold 5.999 billion yuan, down 14.33% compared with the same period last year.

Compared with no one to sell, the net profit of good shops has a bigger problem. In the third quarter of this year, the net profit attributable to shareholders of listed companies was 1,998,400 yuan, a year-on-year decrease of 97.88%.

For the sharp decline in profits in the third quarter, good shops are attributed to the increase in labor and rental expenses and the fluctuation of gross profit margin corresponding to newly opened direct stores. In the past three months, Liangpin Store has opened 145 direct stores, and the number of franchised stores is 146.

This also means that not only consumers, but franchisees are also "abandoning" good shops.

One contrast is that there were only 1,000 Zhao Yiming snacks in February this year, and now there are 2,600 stores in China. The number of stores with busy snacks even exceeds 4,000.

Central China is the base camp of good shops, and nearly half of them are located in Hunan, Hubei and Henan. In this year, the "Snacks Busy" that started in Hunan has entered Hubei, the birthplace of good shops.

"Before this year, snack discount stores all expanded their stores in their own areas, and no one dared to go to Hubei to explore the market," a snack track practitioner told Tech Planet. "Everyone knows that old brands will have geographical advantages."

The impact of new species on good shops has become more intuitive. They open stores near good shops and attract young people in small towns with bright doors and big slogans of "Good Cheap".

Zhang Ji told Tech Planet that there was a snack discount store not far from the store. "It is impossible to say that it has no impact. It must be affecting the business in the store."

As a matter of fact, good shops and new species snack discount stores are both snack collection shops, doing channel business. However, good shops go further upstream, often customizing products with factories, and even cooperating with factories for exclusive products in individual categories. And snack discount stores stay more in the selection. In snack discount stores, each snack has its own brand, and related brands can be searched in e-commerce channels.

Relatively speaking, on the product side, good shops need to have more cost input. Moreover, good shops that have taken the high-end snack route since 2019 have almost strict requirements on raw materials.

Zhao Xin’s factory is to supply nuts to good shops. He told Tech Planet that good shops want the highest specifications and the highest quality raw materials in the factory. "OEM processing, we are all based on customer budgets, what price products we want, and what price we can provide."

There are also suppliers of seafood products who tell Tech Planet that good shops are looking for the goods they want, and the general brands can’t do this price. "They are strict with every link and the production process is exclusively customized."

However, the price reduction of the good shop has not affected Zhao Xin yet. He told Tech Planet that the ex-factory price they gave to the good shops remained unchanged. "This price reduction has not been compressed to our upstream, and the supply price has been discussed for a long time. There is no way to reduce the raw materials of this grade." On the consumer side, the price of this product has dropped from 138 yuan to 103 yuan per session.

Standing four years ago, there was nothing wrong with the high-end strategy of the good shop. However, at the moment when consumers are becoming more rational, the so-called ultimate pursuit of quality by good shops seems to be "going against the trend".

Good shops may be wrong in not keeping up with the needs of consumers and turning in time, which also makes good shops fall into today’s predicament.

Parity becomes a trend.

A year ago, three squirrels also announced their entry into "low price" with the strategy of "high-end cost performance". Zhang Liaoyuan, the founder of the three squirrels, once again posted in the circle of friends that he had been implementing the strategy of "high-end cost performance" after the price reduction was announced by the good shop.

However, the low price seems to have failed to save three squirrels. In the first nine months of this year, good shops sold nearly 6 billion snacks, while three squirrels only sold 4.582 billion, and revenue was also declining year-on-year.

With the change of consumption environment and the surprise attack of new species, the former snack giants now have their own difficulties, and the reality has led them to the road of "low price".

But moving towards low prices also means that they have to compete directly with retail discount stores. The former snack giants need more stores as strongholds to compete with them.

On December 3rd, Zhang Liaoyuan, the founder of Three Squirrels, announced in a circle of friends that the number of offline stores of Three Squirrels has exceeded 150. Before that, three squirrels closed hundreds of stores.

Since the beginning of this year, the stores of good shops have also been in the adjustment stage of opening while opening, and the expansion speed of stores has been slow.

In the past three months, 246 good shops have closed their stores, including direct operation and joining, and 291 new ones have been opened. This means that in three months, only 45 good shops have been added in China. Among the newly opened stores, direct sales and franchise each accounted for half, and the proportion of direct sales stores increased from 37.07% at the end of the second quarter to 39.32%.

In contrast, snacks are busy, Zhao Yiming and other snack discount stores are expanding their stores quickly, and the track has entered the merger stage.

In November, Snacks was very busy and strategically merged with Zhao Yiming Snacks. After the merger, the total number of stores reached more than 6500. And two months ago, Wanchen Group merged the four snack brands: Youpin, Haoxianglai, Yadi Yadi and Luxiaochan.

Snack discount stores are already rushing to the scale of ten thousand stores. Founder Securities recently reported that the number of discount snack stores is expected to reach 22,000-25,000 in 2023.

In terms of the number of stores, the former snack giants did not have an advantage. But they have a supply chain accumulation in the snack track. When they turned in time, the snack industry resumed a new round of "low price war".

However, compared with the blind "volume" low price, today’s price war is the pursuit of the ultimate cost performance, testing everyone’s comprehensive ability and the ultimate control of all links.

Good shops, three squirrels and snack discount stores are back on the same starting line. However, it will take some time for good shops to reverse the "expensive price" label in consumers’ minds.

But good shops should not want the cycle to be too long. Because compared with the new species of snacks, there is not much time left for him. "At the moment, what is before us is not only the problem of living hard, but also the problem of living or not," Yang Yinfen bluntly said in an internal open letter.

Original title: "Good shops cut prices and were forced by snack discount stores? 》

Read the original text